The Investment Opportunity and ROI Journey of Hotmail: A Case Study on Sabeer Bhatia and His Investors

The evolution of Hotmail, from an idea born in late 1995 to a landmark acquisition by Microsoft in December 1997, is a tale of vision, resilience, and the power of virality in the digital age. It’s a story that underscores the transformative potential of tech-enabled enterprises and offers valuable insights into the dynamics of investment, growth, and return on investment (ROI).

The Vision

In late 1995, Sabeer Bhatia and Jack Smith approached the venture capital firm Draper Fisher Jurvetson (DFJ) with a revolutionary idea: a free, web-based email service accessible from anywhere in the world. At the time, this concept was groundbreaking. DFJ saw potential in the idea but also questioned its viability—how would the founders attract users and monetize their innovation?

Despite the doubts, Sabeer and Jack’s conviction in their vision was unshakeable. They were betting on creating a product so essential that it would attract millions of users, even without an upfront monetization model.

The Breakthrough

4th July 1996: Launching Hotmail

DFJ invested $300,000, allowing Sabeer and Jack to launch Hotmail. The timing was impeccable, as internet adoption was accelerating. The free email service quickly gained traction due to its simplicity and accessibility.

The Birth of Virality

Sabeer ingeniously embedded a simple tagline at the end of every email sent through Hotmail: “Get your free email at Hotmail.com.” This clever tactic spurred exponential user growth. At its peak, Hotmail was adding 60,000 users daily, demonstrating the power of viral marketing before the term became mainstream.

1997: Scaling and Attracting Industry Titans

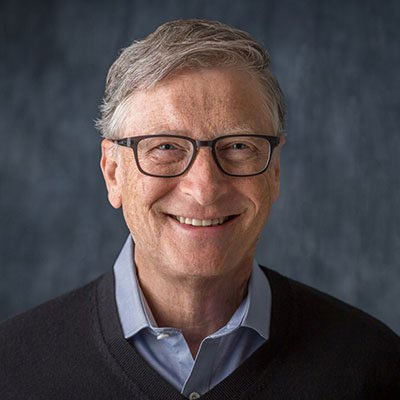

By 1997, Hotmail had amassed 8 million users. The user base’s rapid growth captured the attention of industry giants, including Bill Gates and Microsoft. Microsoft’s initial acquisition offer of $50-60 million was promptly rejected by Sabeer, who understood the potential value of Hotmail’s user base.

Sabeer’s persistence through multiple rounds of negotiations led to Microsoft raising its bid to over $200 million. His steadfast belief in the future value of his creation was vindicated when Microsoft ultimately acquired Hotmail for $400 million in December 1997.

The Missed Opportunity

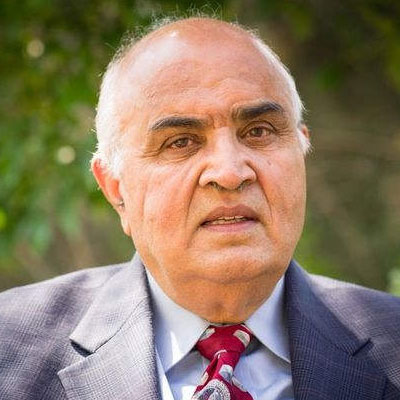

In the fall of 1997, Sabeer sought an additional $1 million in investment from Kanwal Rekhi, a founder of TiE Global. While initially skeptical about monetization strategies, Rekhi eventually warmed to the idea, agreeing to invest after his return from India.

However, during his trip, news broke of Microsoft’s acquisition of Hotmail. Rekhi missed his chance to invest in what would become a legendary ROI success story.

The ROI Math: Why Hotmail Was a Strategic Gem

For Microsoft

Microsoft was struggling with its MSN service, which had cost $2 billion to develop but garnered only 1 million users. This equated to a customer acquisition cost (CAC) of $2,000 per user.

With the $400 million acquisition of Hotmail, Microsoft gained 10 million users, reducing its CAC to just $40 per user. For Microsoft, the value lay in integrating Hotmail’s user base into its ecosystem, dramatically enhancing the utility of its existing services.

For Sabeer and Early Investors

The $300,000 initial investment by DFJ yielded extraordinary returns in less than 18 months, highlighting the immense upside potential of tech-enabled enterprises. Sabeer’s vision and determination turned Hotmail into a $400 million success story, delivering massive ROI for early believers.

Key Takeaways

- Vision Drives Value: Sabeer’s ability to see beyond immediate monetization and focus on building a massive user base was instrumental. He understood that user acquisition was the real asset.

- Virality as a Growth Engine: The innovative use of viral marketing proved to be a game-changer, showcasing the value of network effects in tech-enabled enterprises.

- Strategic Acquisition Value: An asset’s value often depends on the acquirer’s ability to leverage it. For Microsoft, Hotmail wasn’t just a product but a gateway to millions of users, creating immense synergies with its ecosystem.

- Investment Timing Matters: Investors like DFJ reaped huge rewards for their early belief in Sabeer’s vision, while latecomers like Kanwal Rekhi missed out, illustrating the importance of timing in venture capital.

Conclusion

The Hotmail story is a testament to the power of innovation and vision in creating transformative enterprises. For founders, it underscores the importance of persistence and strategic thinking. For investors, it highlights the potential rewards of backing bold ideas in the tech space.

Hotmail’s journey—from a modest idea to a $400 million acquisition—continues to inspire entrepreneurs and investors, serving as a benchmark for what’s possible in the ever-evolving world of technology.

Synopsis: Case Study: Sabeer Bhatia: Hotmail

- Late 1995

- Sabeer Bhatia & Jack Smith approached Venture Capital firm Draper Fisher Jurvetson with their idea for a free email service.

- Draper Fisher Jurvetson praised the idea but wondered how they would attract members and build a company around it.

- 4-July-1996

- Raised US$ 300,000 from Draper Fisher Jurvetson

- Launched Hotmail

- 1997

- When Hotmail users touched 8 million, the industry began to take notice.

- Soon, Bill Gates of Microsoft came with the first offer of US$ 50-60 Million, which Sabeer promptly rejected.

- Sabeer dug in through round after round of negotiations that saw Microsoft lift its bid to US$ 200 Million and more…

- Oct-1997

- Sabeer sought US$ 1 Million investment from Kanwal Rekhi, Founder of TiE Global

- But since Hotmail was free, Kanwal would say why not charge a dollar a month? Sabeer did not want any friction in way of acquiring users. Sabeer would talk about building a user base of 10 million. He invented virality and was getting 60,000 users a day at one time. He would talk about upselling to those users. Kanwal would say, Sabeer, you have nothing to upsell.

- Kanwal initially passed on his request for investment because he could not figure out how he would make money.

- Kanwal finally warmed to investing US$ 1 Million in his company just as he was on his way to India in the fall of 1997 and said that he would invest when he is back in 2 weeks.

- While in India, news broke that Microsoft was acquiring Hotmail for US$ 400 Million.

- Kanwal was shocked to hear this missed opportunity.

- Dec-1997

- Microsoft completes its acquisition of Hotmail for US$ 400 Million

- The Math:

- Sabeer did not have anything to upsell, but Microsoft did.

- Microsoft had spent US$ 2 Billion to build its MSN and had only 1 Million users.

- Customer Acquisition Cost = US$ 2,000 per user

- With the acquisition of Hotmail it was acquiring 10 million users for only US$ 400 Million.

- Customer Acquisition Cost = US$ 40 per user ONLY!

- An asset has a different value in the hand of a different user.

- Value is in the eye of the beholder.